Xero is one of the most popular cloud-based accounting suites for small and mid-sized enterprises ranked the second largest provider of accounting and cloud core financial management software. Though it is loved for its core bookkeeping and financial features, Xero also is known for its seamless integration with over a thousand third-party apps and services.

This post outlines how you can use Xero integrations to make daily accounting and financial management processes more streamlined. It goes into detail on Xero’s integration with online systems to help end-users and developers using Xero and these other online systems.

What is XERO integration?

Xero integration refers to the ability to connect external tools and services to facilitate some type of functionality, process, or exchange of information with the core accounting system. Xero’s integration with third-party services and tools is achieved through Xero’s application programming interface (API).

By the time of posting this, Xero officially supports over a thousand apps and services as compared to six hundred and fifty by its closest competitor QuickBooks. What’s more, any small business can build its integration using Xero’s API.

Reasons for Xero Integration

Xero’s developers have worked hard to open up their service to third-party apps and services. Here is why integration is important for this kind of software and how you might benefit as an end-user or developer:

1. Real-Time Automated Data Sharing

Integrating other apps and services with Xero allows you seamlessly share data between the apps in real-time making you more productive because it eliminates manual data entry. Any data you need to be entered into your accounting software automatically flows into Xero.

Real-time data sharing using Xero integration allows you or your accounting team to spend time doing real accounting and financial management tasks. For example, day-to-day transaction from third-party payment processing services such as PayPal and Stripe automatically flows into Xero and can be factored into business expenses or incomed automatically.

2. Good for Accountability and Tracking

In a typical organization, people are likely to be using different tools and services to do their work and records. For instance, some departments may be using the ERP for their daily tasks and recording transactions while others use CRMs for their line of work. All the services and systems you use in your organization generate important transactional records that need to be recorded in your accounting system.

Xero integrates with most business systems through its open application programming interface. By enabling integration with Xero, you can pull transactional data from every system in your organization for easy accountability. You won’t need to ask employees to email their transactional records to accounts or access Xero to input them manually.

3. Xero Integration Helps with Collaboration

Some of the apps and services that integrate with Xero depend on collaboration to work properly and often have teams from different parts of an organization. Xero allows real-time collaboration between accounting/finance and other teams with third-party app integration. For example, marketing teams can share their plans with your finance team from their marketing system for approval.

4. Better Customer Experiences

Xero integrates with various apps and services that your customers use to transact with you. The integration enables them to have seamless access to your customer-facing systems so that they don’t have to use more than one system to transact with you.

As an example, Xero integrates with virtually all payment processing services (PayPal, stripe credit card checks off, and the rest). Ecommerce businesses accepting online payments don’t have to force subscribers to use one payment service. They can automatically get the transaction data they need to plug into Xero for cash flow tracking and general bookkeeping

5. Enables Compliance with Data Privacy Laws

Xero integration with third-party apps also helps business ease their compliance burden. For instance, by offering access to third-party finance apps and services, they don’t have to worry about breaching the Payment Card Industry Data Security Standard (PCI-DSS) Since they are not holding any customer data on their servers. All private customer data needed to approve payments is processed by third-party services and Xero records what is relevant for bookkeeping.

6. Xero Integration Enables Data Security

By automation the sharing of information through its secure API, Xero eliminates the need to send or receive sensitive accounting or finance data using other less-secure channels. The direct communication between Xero and other services/applications is good for data security and data integrity. For instance, accountants do not have to receive invoices over email because Xero integrates with most invoicing systems for direct data sharing.

Key Features of Xero Integration

Xero integration offers a range of powerful features that allow businesses to streamline their financial processes, enhance data accuracy, and improve overall efficiency. Here are some key features of Xero integration:

Data Synchronization

Xero integration enables the seamless exchange of data between Xero and other software applications. This includes syncing financial transactions, invoices, bills, contacts, and more. By automating data synchronization, businesses can eliminate manual data entry and reduce the risk of errors.

Real-Time Updates

Integrating Xero with other tools ensures that financial data is updated in real time. This means that any changes made in one system are reflected immediately in Xero and vice versa. This real-time visibility into financial data is crucial for making informed decisions and staying up-to-date on your business’s financial health.

Automation

Xero integration allows businesses to automate various financial processes. For instance, when an invoice is created in your CRM system, the integration can automatically generate the corresponding entry in Xero. This automation saves time, minimizes repetitive tasks, and improves workflow efficiency.

Payment Gateway Integration

Integrating Xero with payment gateways or e-commerce platforms enables automatic recording of sales and payments. When a customer makes a purchase online, the integration can create an invoice in Xero and mark it as paid once the payment is processed, reducing manual reconciliation efforts.

Inventory Management

Businesses that deal with inventory can benefit from Xero integration with inventory management systems. This integration ensures that changes in inventory levels, product prices, and sales are accurately reflected in both systems, preventing discrepancies and improving inventory control.

Employee Payroll

Integrating Xero with payroll software simplifies payroll management. Employee salary information, tax deductions, and benefits can be seamlessly transferred to Xero, making payroll processing more efficient and accurate.

Customer Relationship Management (CRM) Integration

Integrating Xero with a CRM system enhances customer insights. Sales transactions recorded in the CRM can be automatically linked to Xero, allowing for better tracking of customer purchases, payments, and outstanding balances.

Reporting and Analytics

With Xero integration, businesses can generate comprehensive financial reports that consolidate data from various systems. This provides a holistic view of the company’s financial performance and aids in making data-driven decisions.

Multi-System Consistency

For businesses using multiple software tools, Xero integration ensures consistency across different systems. This reduces the risk of data discrepancies and ensures that accurate financial information is accessible to all relevant parties.

Custom Workflows

Xero integration can be tailored to match specific business processes and workflows. Customization allows businesses to map data fields, automate tasks, and create unique rules that align with their operational needs.

Scalability

Xero integration is scalable, accommodating the growth of businesses. As your company expands and adopts new software solutions, Xero’s integration capabilities can evolve to meet changing requirements.

How Does Xero Work with Social Media?

Xero is one of the few online accounting software that allows you to integrate with major social media marketplaces for automated transaction recording and processing. With direct social media selling becoming popular, this is a great convenience for most merchants.

You can easily connect major social media selling accounts (Instagram, Facebook Marketplace, and others) with Xero using the automated API. The integration with Xero allows you to automate various accounting-related processes like recording sales invoices, tracking payments, tracking ad spending, etc. Social media integration can be done using Xero’s open API in a few easy steps.

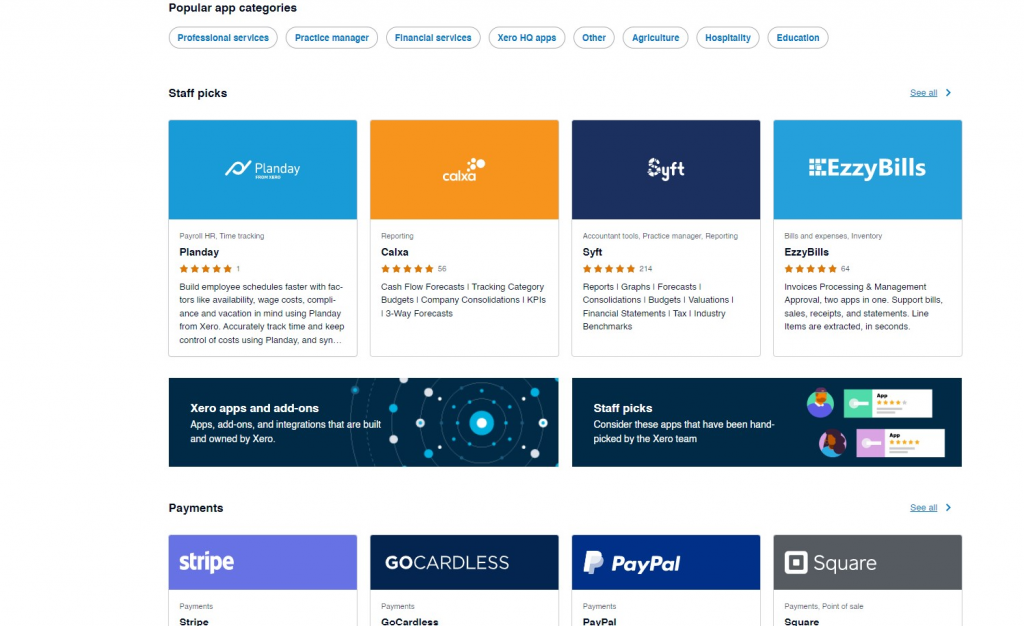

What Integrations Does Xero Have?

Xero has over 1000 official integrations with popular online applications and services. From credit card/debit card processing systems to popular point of sale (pos) providers, inventory management systems to popular online stores like Amazon and Walmart. The integration enables apps and services to share data with Xero and automate transactions.

Examples of Xero Apps and Add-Ons

Below is a list of some of the popular apps and services that offer automated integration with Xero:

- Stripe

- PayPal

- Hubdoc

- Hubspot

- Mailchimp

- Microsoft Outlook

- Shopify

- Square

- Gocardless

- Veem

- Invoice Stack

- Invoice Bright

- Airsquare

- Katana

- Taxify and many others

A comprehensive list of apps and services that offer automated integration is available on Xero’s searchable app store database. Businesses can also integrate their proprietary systems with Xero through its API with minimal coding required. Connect your online systems with Xero today and enjoy seamless transaction processing.